How CIOs Drive Digital Transformation in Banks

Digital banking platforms are increasingly must-haves for banks because they’re essential components of any bank’s digital transformation efforts. But there’s no single path to digital transformation.

The key factor in selecting a digital banking platform is a bank’s progress in the journey toward digital transformation. CIOs should work with their business to evaluate their digital goals and risk tolerance to determine which of two types of platforms will best suit their banks’ needs.

Choosing the right platform banks are ready to achieve the right digital success but there are some challenges to it.

- There is no single path to digital transformation that exists, which means there’s no one-size-fits-all digital banking platform that will meet every institution’s needs.

- Bank CIOs are often unaware of the segmentation in the digital banking platform market and which questions to ask before deciding the types of digital banking platforms to evaluate.

This article will help CIOs evaluate, select, and implement digital banking platforms that are appropriate for their enterprise-specific needs.

Gartner has offered bank CIOs best practices for evaluating digital banking platforms based on their firms’ digital capabilities, risk tolerance, and other critical factors.

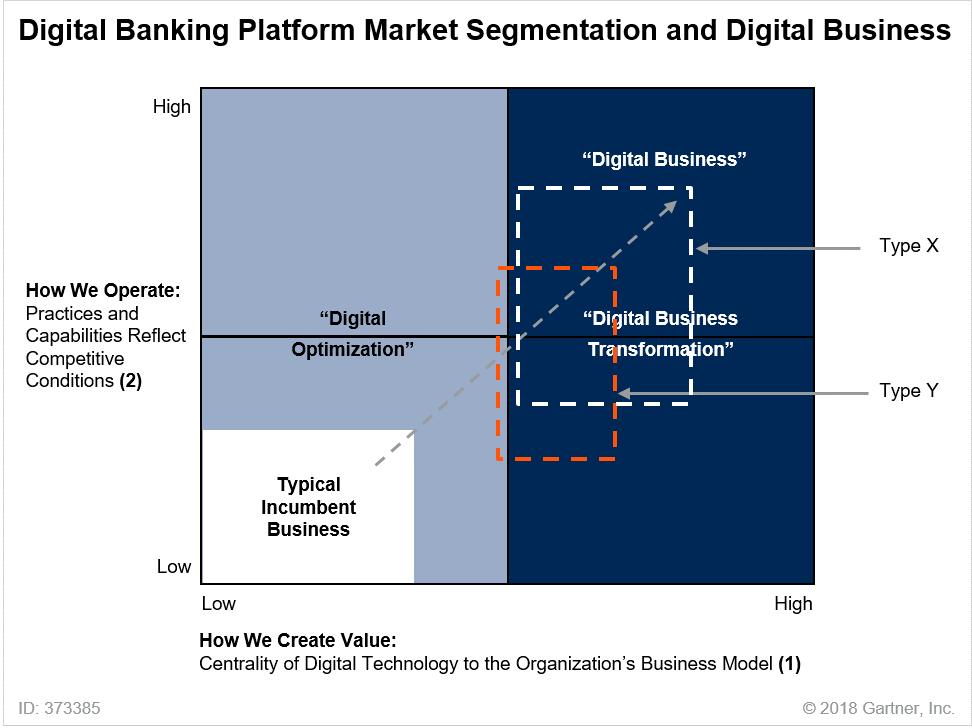

Gartner has identified a fundamental segmentation of this market in the digital banking platform market with two distinct market segments emerging into two categories i.e., Type X and Type Y. each of which focuses on different aspects of transformation.

Type X supports foundations for digital business. Type Y supports digital transformation focused on aggressive business optimization.

A CIO’s choice of digital banking platform — Type X or Type Y — must be based on the bank’s degree of digital transformation, willingness to accept the risk, and other critical enterprise-specific factors.

There are two steps to assess which type — Type X or Type Y — of digital banking platform is more appropriate to deliver on the bank’s digital transformation strategy.

- By determining whether your bank’s digital transformation requirements meet the key capabilities of Type X or Type Y digital banking platforms.

- Evaluating the platform capabilities to confirm that the platform strategy conforms to your bank’s transformation strategy.

Work with Your Business Peers to Determine Your Bank’s Digital Platform Requirements

Bank CIOs who have determined that the DBP approach is appropriate for their bank’s digital strategy have to take the next step to understand the depth of digital transformation the bank requires. To do this, the CIO must work with her business peers to evaluate the bank’s current state of digital transformation and its tolerance for digital risk.

To determine the digital transformation strategy and conclude a digital banking platform is a right approach to support that strategy is critical. As digital transformation is not a single endpoint. And digital transformation can drive toward digital business and it can focus on transformation within financial services. Both types of transformation demand different types of digital banking platforms.

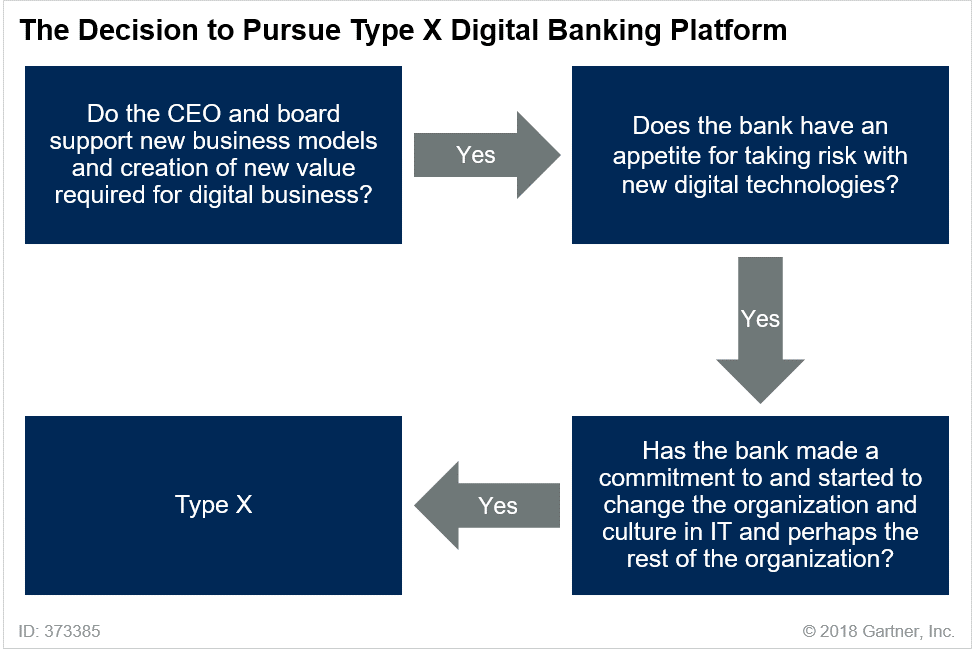

To make this assessment, CIOs establish should take care of:

- Which kind of digital transformation the CEO and board support and are committed to.

- The bank’s appetite for digital risk to experiment with, partner, and use emerging technologies and fintech and startups that develop them.

- Whether IT and the business organization have started or have committed to starting organizational and cultural change required to support digital business transformation.

- Clarification of the digital banking initiative by creating high-level documentation outlining the business and IT benefits of the digital banking approach.

These variables will provide clarity about the bank’s — especially at the CEO and board-level — support and investment in the digital banking transformation strategy. It will assist the bank CIO in determining which type of digital banking platform is likely to be appropriate to fulfill her organization’s digital transformation strategy.

Overview of the process to determine which type of digital banking platform is appropriate to implement the bank’s digital transformation strategy.

It is critical to remember that one set of questions alone should not lead the CIO to assume what to pursue either a Type X or Type Y digital banking platform.

Figure 2

Figure 2 shows how the high-level outcome of the CIO’s evaluation leads to the decision to pursue a Type X digital banking platform.

The digital banking platform (DBP) approach goes beyond the automation or digitalization of existing bank transactions and business processes. Crucially, it also encompasses technologies that enable banks to create new business designs that bridge the digital and physical worlds.

In reality, not all digital transformation strategies are the same. Some digital transformation efforts primarily focus on aggressive business optimization. These efforts seldom extend beyond more traditional boundaries of banking and financial services. Other digital transformation efforts primarily focus on new value creation and increasing the bank’s digital business. These efforts typically go beyond the traditional boundaries of financial services.